Cryptocurrency or digital token exchanges are websites where one can purchase, sell or exchange digital tokens for other digital tokens or traditional fiat currency (e.g. USD or SGD).

There are 2 main types of cryptocurrency exchanges:

1. Fiat-to-Crypto (Beginner friendly)

2. Crypto-to-Crypto

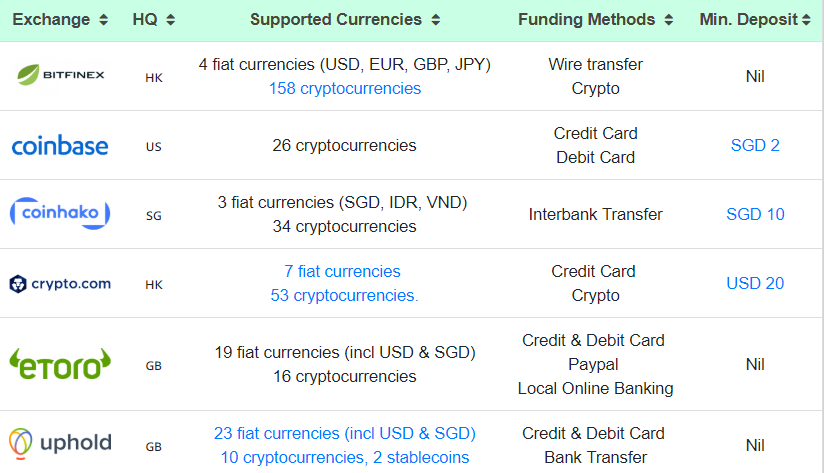

Fiat-to-Crypto Exchanges

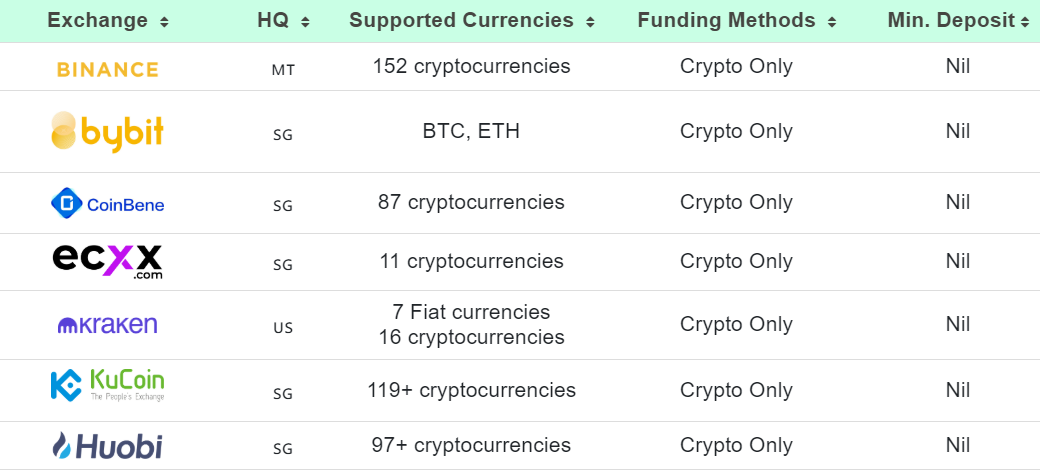

Crypto-only Exchanges (At A Glance)

Are the exchanges regulated by Singapore authorities?

Short answer, not yet. This partly explains why so many of the major cryptocurrency exchanges are based in Singapore.

Things are soon to change. In January 2019, Singapore’s parliament passed the Payment Services Act, bringing cryptocurrency dealing or exchange services under the supervision of the Monetary Authority of Singapore (MAS), Singapore’s central bank and financial regulator. Under the Payment Services Act, any entity that provides any type of payment service needs a license entitling the entity to carry on a business providing that type of payment service, unless exempted. The Act regulates seven types of payment services, including “digital payment token service.” The Payment Services Act and its subsidiary legislation, which would contain substantive license application forms, processes, and procedures, are expected to take effect in the later part of 2019.

Fees

When deciding which exchange to use for trades, fees are a key consideration. Here’s an explanation of the usual fees to look out for.

Deposit / Withdrawal Fee (paid to exchange platform)

Some platforms charge fees upon the deposit/withdrawal of funds/crypto from the platform.

Trading Fee / Spread (paid to exchange platform)

- A taker fee is charged if the trade order is matched immediately against an order already on the order book, removing liquidity.

- A maker fee is charged if the trade order is not matched immediately against an order already on the order book, adding liquidity.

- Profit-only fees — some exchanges don’t charge trading fees but impose a higher charge on any profits made from your trade.

- Spreads are the difference between the highest buy price and lowest sell price in the market. The spread that is enforced by the platform protects the platform from making a loss in selling cryptocurrency to you by selling under current market prices.

Network transaction fees (paid to miners)

Every time you send cryptocurrency from one wallet to another, you incur a network transaction fee. This is the fee that is paid to confirm your transaction on the blockchain.

The actual amount of fees vary depending on the cryptocurrency (Bitcoin, Ether, or Litecoin etc), the network capacity, and the market demand (i.e. how many transactions are looking to get confirmed at this point in time).

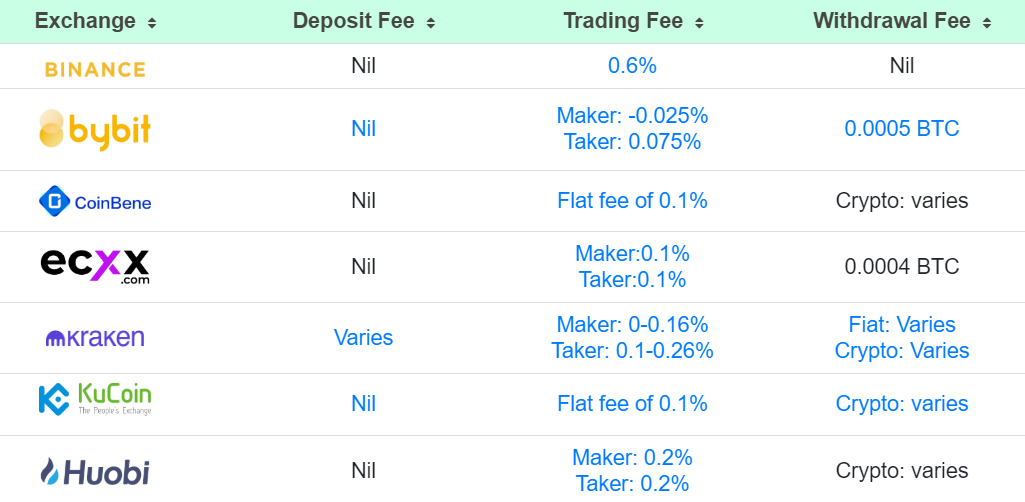

Here’s a snapshop of the fees charged by the fiat-to-crypto and crypto-only exchanges featured above. Crypto-only exchanges generally have more competitive trading fees than fiat-to-crypto exchanges.

Fiat-to-Crypto Exchanges (Fees)

Crypto-only Exchanges (Fees)

Promo Codes

- Sign up with Coinhako and use code PENNYWISE to enjoy trading fees of 0.70% (usual rate = 1.00%).

- Sign up with crypto.com using this referral link and get USD 50 upon successful account set-up.

Enjoyed this post?

- READ MORE:

- Read TABUL8TOR’s beginner’s guide to blockchain, cryptocurrencies, cryptoccurrency exchanges, cryptocurrency wallets.

- Read TABUL8TOR’s post on web-browser based wallets.

- Read TABUL8TOR’s review of cryptocurrency cards and cryptoback apps.

- LIKE ⭐ SHARE 🤲 & SUBSCRIBE👣

***Disclaimer: This post is for informational purposes only and does not constitute a recommendation to buy cryptocurrencies. Please do your own due diligence before taking any action.